Stop Taking Out Student Loans and Do This Instead

$1.64 trillion

You might be wondering right now, what is this number? Why is it in bold at the top of the page?

Is it the GDP of a country? Or maybe it is the market cap of a tech giant like Apple?

No and no.

$1.64 trillion is simply the current student loan debt in the United States! According to the U.S. Department of Education, the average amount of debt owed by the graduates of the 2020 class hovers around $35,000 per person.

Given the importance of higher education and how it is often seen as the main determinant for one’s potential prospects in the labor market, a lot of students are “forced” into taking on this much debt to have a fighting chance for employment opportunities. However, starting out your life with that much debt could have some negative repercussions, and here is why.

It May Take a Very Long Time to Pay It All Back

Most undergraduates are unaware of how difficult it can be to score a high-paying job right out of college. In fact, this has become significantly more difficult given the current economic situation after the COVID-19 outbreak.

Not to mention, people who have been laid off will always have the upper hand in any vacancy that pops up because they have previous experience in the market.

This means that if you have to settle for a minimum wage job then it could take years for you to pay back your entire debt. This puts you in a never-ending spiral because the longer it takes you to pay off your debt, the more interest will accrue and the more you will have to pay!

It Is Almost Impossible To Have It Just “Go Away”

Some forms of debt such as a mortgage and auto loans can be forgiven during bankruptcy.

However, this is definitely not the case when it comes to student loans, which have to be paid even if you are struggling to find a job, or even if you did not actually graduate at all! And they definitely will not be taken away during bankruptcy proceedings.

So, unless you are part of the Public Service Loan Forgiveness Program, there is absolutely no way to avoid paying.

It Will Delay All Your “Big Moves”

Are you trying to buy yourself a house? Or lease an apartment? Or maybe get a car?

Unfortunately, these things will be impacted by your student loan debt. And if they are not handled properly, student loans will significantly increase your debt-to-income ratio.

This ratio is one of the main factors that banks carefully consider when deciding whether or not you would qualify for a mortgage and at what rate.

Not to mention, that if you, for whatever reason, miss on a payment, it can be quite detrimental for your credit score (another important factor when it comes to getting loans).

But don’t worry, it is not all dark and bleak. Several alternative financing mechanisms can help you completely avoid this type of debt and even give you a good head start on your path to financial freedom. Let us take a look at a few options below and you can also read more from DebtFreeAdventure on this subject.

Be Strategic Regarding Your Journey in Higher Education

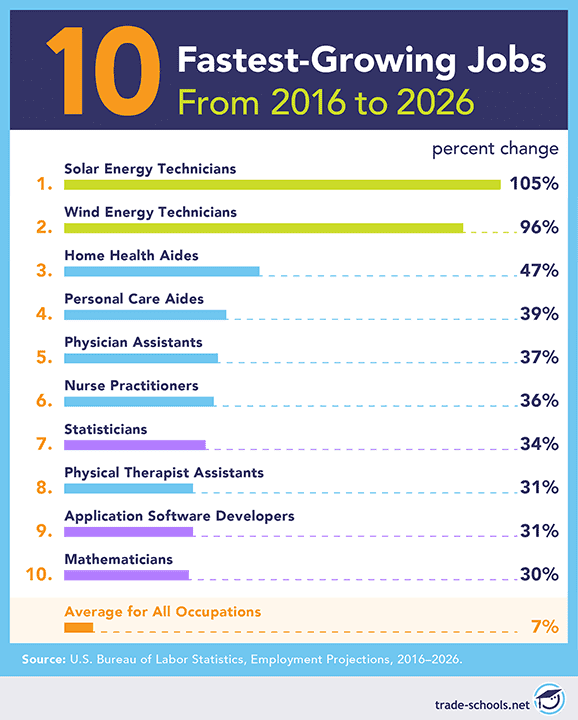

As you approach your senior year in high school, you have to ask yourself the question of whether or not college is really for you.

If it is, then do you need a 4-year university, or can you “get away” with community college? Or you can perhaps attend a state school, as they are usually much cheaper than their private counterparts.

Step Up Your Game In High School

Do your best to try to stand out from your peers. Take as many AP classes as possible. They will help decrease the number of classes you need to take to graduate and will significantly reduce your tuition in the long run.

Self-awareness is key here, the earlier you realize what your passions and skills are, the more you can capitalize on them. If you are a good test taker and able to excel at your courses, then you should aim to get an academic scholarship.

On the other hand, if you are into a certain sport, then make sure to put in the hours necessary to become as good as you can be, which will increase the chances that you land an athletic scholarship.

There are also other scholarships for music, art, and theater, so feel free to explore! There are even more ideas here: https://www.thecollegesolution.com/increase-admission-chances-40/

Just make sure to explore all the possible options, which leads me to the next point.

Grants and Scholarships

Make sure to apply to as many as possible and not just to the ones offered by your university. There are plenty of organizations that also offer scholarships. It is important to be as resourceful as possible. At the end of the day, the opportunities are there. It is just a matter of who utilizes them to the fullest.

However, do not ever depend solely on scholarships and grants when it comes to paying your tuition because, apart from ones offered by your college, none of them are truly guaranteed. Therefore, you should always have other go-to options in case something happens.

Do Not Forget the FAFSA

Make sure to file your FAFSA every single year! Doing so will give you the best shot at receiving financial aid. Nevertheless, even if you do not get any support out of it then at least the government might offer you loans with better interest rates than the ones you would have had to pay for a private loan.

Stick to Your Budget

Make sure you understand your expenses and stick to your budget. Most universities will give an estimated expense amount that people should expect to pay annually outside of tuition. This will give you a good idea of the amount of money you need to “survive”.

Once you have that number figured out then you should plan accordingly. This is when jobs and side hustles can come into play. Be as entrepreneurial as possible with your endeavors. In other words, smart work trumps hard work every single time. From online freelancing to affiliate marketing, there are a lot of ways you can build profitable side hustles.

Save, Save, and Invest!

As mentioned in the previous point, there are countless ways to start a profitable side hustle, however, it is important to note that income from such endeavors can be quite sporadic at times. Therefore, always make sure to invest a certain percentage of that income into either a savings account or perhaps into capital market instruments like stocks.

At the end of the day, escaping the weight of those student loans is a combination of working hard, being resourceful, and proper budgeting. If you stick to those principles, then you will be on the right path to achieving all your financial goals.